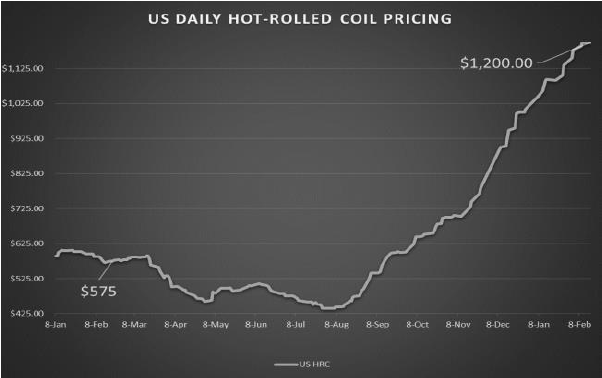

Like everyone in our industry, we’re dealing with volatile material prices. We’ve seen prices of our key inputs; stainless steel, aluminum, and mild steel skyrocket. Why is this happening? COVID unleashed a massive cut in production capacity that has yet to recover. In steel, the US went from over 80% utilization rate of steel capacity to less than 60% in three weeks. That is the equivalent of 800,000 tons of steel per week of lost production. In contrast, the recovery to 77% has taken over nine months.

Further to that, while capacity should eventually come back online, we have yet to catch up to existing backlog and we expect an even greater resurgence in demand as the economy reopens. This could create an extended period of volatility with input prices remaining higher for longer than expected.

How long will prices keep rising?

A lot of this depends on China. A good portion of this current phase was due to Chinese stimulus spending in 2020. The question is, will that spending continue into 2021. Goldman Sachs seems to think the cycle will continue, while others say that the supercycle won’t happen.

Further to that, we’re hearing of distributors that went offshore to source are now being shorted with delays lasting for weeks to months. And there are no clear signs that domestic capacity is coming back online quickly enough, and when it does it will be to only catch up to existing demand.

We’re not sure how long this will last and neither are the experts. But what we do know, is that we’re in a period of heightened volatility, and we need strategies to manage it.

We’re managing volatility by remaining flexible

While we don’t truly know the duration or scale of this current commodity boom, there are ways to manage the current volatility. We’ve seen many booms and busts in commodity prices. Although this one seems to be particularly unique, we expect supply to eventually come back into the market. Primarily we’re focused on remaining flexible in our organization in the following ways.

Keeping communication between buying and sales teams

Volatility means we need our buying and sales teams to stay in constant contact. Price fluctuations coupled with supply issues on our buy-side are communicated daily to our sales teams. This has actually helped us create a more integrated, flexible organization. Something we intend to keep even after the volatility is over.

Just in time. Sell to market price.

We’ve adjusted our sales strategy to sell directly to market price and have focused on a just-in-time inventory strategy. While this introduces some volatility into our revenue structure, it allows us to maintain healthy margins during the volatility.

More aggressive on the buy side

While we’re used to being aggressive on pricing on the sell side, we’ve adapted to become more aggressive in securing and maintaining a supply of inputs. This is something we haven’t had to do in the past, but has made our company stronger and better prepared to buy when the moment arises.